The primary reason people give is to help, not to get tax benefits

When the new Tax Bill passed, I wrote How Worried Should Your Nonprofit Be? That was back in January, when the impacts of the new law on philanthropic giving may have seemed remote. Now the end of the calendar year is closing in, so it’s worth taking a look at some of the ways you can help your major donors get the biggest bang for their donation.

Keep in mind, of course, the primary reason people give is not to get a tax deduction. It’s to see themselves reflected in a mirror as the person, deep down, they really want to be.

That being said, if you want gifts you must give them. Help more than you sell.

And one gift you can offer is a little bit of wisdom about ways donors can maximize the impact of their gift and minimize the cost to themselves. Especially when you’re talking to major donors. Because, for most of them, the impact of the new tax law will truly be icing on their philanthropy cake.

New Tax Law Facts that Apply to Most Major Donors:

The lion’s share of all philanthropy comes from a small slice of donors at the top. These people were amply rewarded by the new tax law.

- They have more disposable income this year due to tax cuts.

- They won’t be taking the standard deduction because it’s lower than the amount they’ll be donating (whether just to you, or as a combination of philanthropy to two or more other causes).

- Their income tax deductions may be more valuable this year in some states and localities due to limitations on state and local taxes deductions that may actually increase the effective rate of state taxation.

- They can deduct up to 60%, rather than 50%, of Adjusted Gross Income (AGI) this year.

Okay, so what’s your job given these facts? And given what we know about what motivates philanthropy?

1. Balance Donor Needs and Organizational Needs

First, you must meet your donor’s need to be part of something larger than themselves. To find a greater purpose. To connect with a like-minded community. And, generally, to feel the joy – the actual dopamine rush– that comes from giving.

It helps to know your donor at least a little bit. By paying attention to what they show you when they give. And to what they tell you (in person, on the phone, via survey, via comments on blog posts and via social media). And to what emails they open and what links they click on. And to what events they attend. And to what programs they earmark their gifts. And to any of the many ways they may be tentatively, or actively, involved with you.

Next, you must match your donor’s needs, interests, and values to the needs your organization meets. You must ask them to help you fix a specific problem; then suggest a specific solution that will make an impactful difference. And what you ask them for should resonate with what you know about them. You’ve got to show you’re paying attention, and it’s not all about you and your needs. It’s about them.

This is what will motivate someone to make a passionate gift!

2. Lead with Emotional Reasons to Give

When you focus on tax deductions, you play to selfish motives rather than selfless motives.

I’ll wager you never really thought of it that way. Am I right?

You don’t want to lead with tax deductions!

Your year-end fundraising should lead with emotion-packed stories that connect donors with values they’d like to enact. You want to show them how they can be HEROES and VISIONARIES, or at least just very good, kind, compassionate people.

Once you’ve inspired someone to make a philanthropic gift, then you can offer up some helpful tax-beneficial tips.

3. Help Donors Maximize their Impact and Benefits

When you help people make a larger gift than they might have thought possible… or help them avoid paying taxes… or otherwise help them to be more strategic with their financial and philanthropic planning, they will reward you. So here are some things you might suggest this year when working with major donors:

- Suggest they consider an IRA charitable rollover if they’re 70 ½ or older to satisfy their required minimum distribution and act philanthropically.

While this option won’t give them a federal income tax deduction, this strategy will avoid federal income tax (and often state income tax as well) for the amount of the gift.

Here’s an example of an email I recently received:

When the reader clicks on “learn more,” they’re taken to a page that reminds them first and foremost they’re helping to improve lives; then, they’re acting in a “tax-smart” manner:

CONSIDER AN IRA GIFT TO JFCS

Help improve lives, using the tax-free Charitable IRA Rollover

The Tax Cuts and Jobs Act of 2017 changed the former advantages of itemizing charitable donations on our tax returns for many of us. However, as a senior, you can continue to make gifts to JFCS and other qualifying non-profit organizations that are both tax-free and tax-smart!

Save Tax Dollars and Improve a Life

- Suggest they strategize by “bunching” and make several years’ deductible gifts in the current year.

For those who may have more income or windfalls this year, itemizing their deductions this year will make sense. If they expect to have significantly less income next year, to the extent they might opt to use the standard deduction, you can give them ‘credit’ for their 2019 gift (or beyond) based on this year’s philanthropy.

- Ask if they have a Donor Advised Fund (DAF) from which they’d like to make a distribution.

Some donors ‘bunched’ donations last year when the new tax law was passed. Many consolidated the equivalent of two to three years’ worth of giving into one gift to a DAF. They got a large tax deduction last year, and can now recommend distributions from their DAF to your charity (and others) this year and over ensuing years. They just may have forgotten this little ‘burning pocket,’ and it’s a painless way to give to you now. It can’t hurt to ask if they have a Fund, and if they’d like to make their distribution to you from this Fund. You may end up with a larger gift than you’d otherwise have received — just because you gave them a reminder!

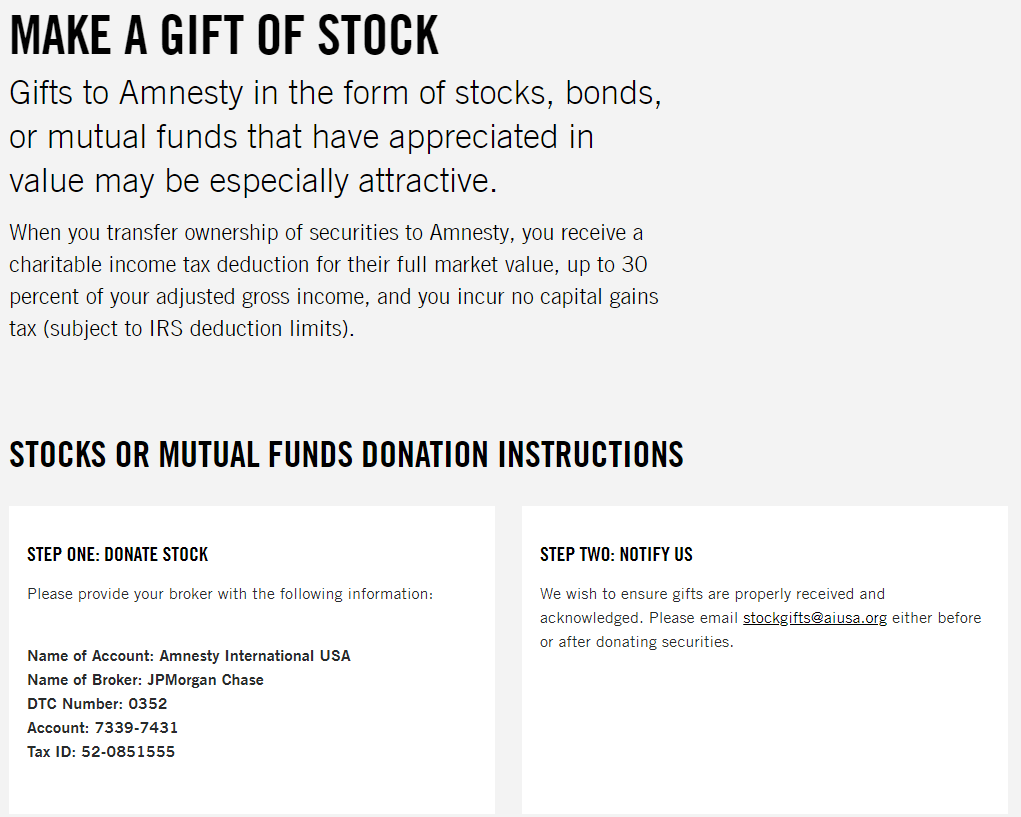

- Ask if they have appreciated securities or other property.

Promoting stock gifts has been shown to dramatically increase contributions – by as much as 66%! It’s almost malpractice not to suggest to donors they may want to make their gifts this way. It’s beneficial for them, and it’s beneficial for you. Total win/win. And it’s not difficult to accept these gifts.

Here’s an example of how to instruct donors on your website:

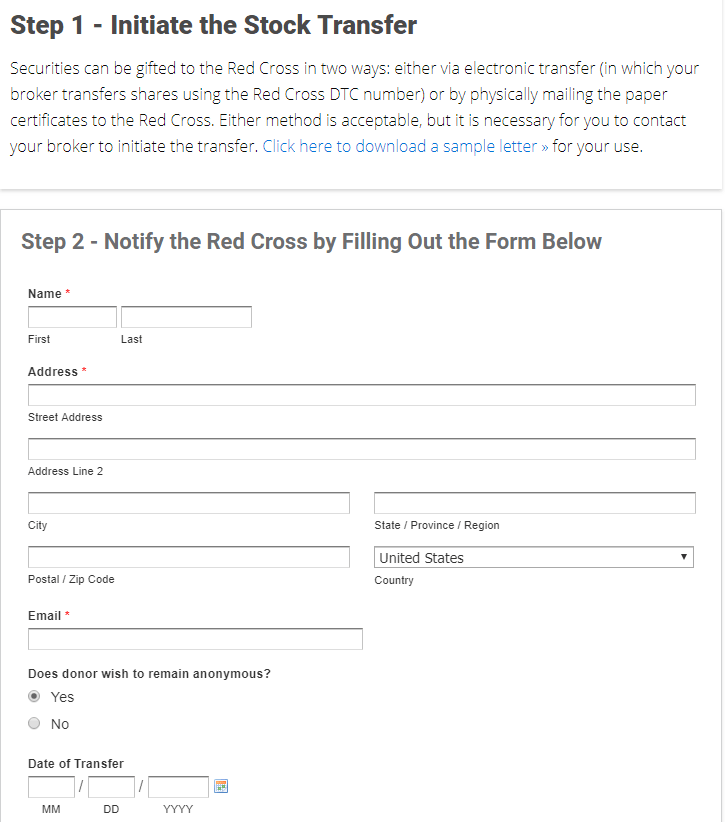

Here’s another example that includes a simple form donors can complete to let you know they’ve authorized a transfer:

Want to Ramp Up Major Gift Fundraising?

You can’t afford not to ask for major gifts!

If you’re thinking you wished you had more donors you could talk with about these tax-smart ways to give, never fear. Next year’s almost here!

Consider this a heads-up I’ll be offering my popular 8-week Winning Major Gifts Strategies e-course again commencing mid-January. You’ll learn everything you need to know to set up (or accelerate) a strong major gift program. With the reduced tax incentive to give for small and mid-level donors, it makes sense to focus efforts on wealthier donors. If you’re not making many face-to-face visits and asks, you need to start.

NOTE: Registration will open in mid-December with a not-to-miss ‘early bird’ discount. If you’d like me to remind you to sign up (slots are limited), just let me know!

Major gift fundraising has always given charities the biggest bang for the buck. Moving forward, this will be truer than ever.

Photo by Matthias Zomer from Pexels

NOTE: Though I do have a J.D. after my name, I am neither a tax attorney nor a certified financial planner. Please consult your own advisors and advise your donors to do the same regarding their personal situations.

-

Pingback: How to lead your donors through changing tax deductibility