Does your nonprofit promote stock gifts? You should!

Does your nonprofit promote stock gifts? You should!

A groundbreaking study by Dr. Russell James J.D., Ph.D., CFP®, professor in the Department of Personal Financial Planning at Texas Tech University, found nonprofits that consistently received gifts of appreciated stocks grew their contributions six times faster than those receiving only cash.

This is HUGE.

If you learn to ask for gifts from appreciated assets you’ll get more generous gifts. The study shows:

- Received only cash gifts = 11% growth.

- Received any kind of non-cash gift = 50% growth. Included gifts of personal and real property and deferred gifts.

- Received securities non-cash gifts = 66% growth. Massive difference from just this one strategy!

You Don’t Have to Get Fancy

The most productive strategy is simply to accept gifts of stock.

But it’s up to you to offer up this giving framework to your supporters. Otherwise, they’re apt not to see this as an opportunity.

And speaking of ‘framing,’ this can establish a persuasive reference point for would-be donors. Researchers have found people don’t treat all their money as if they have one big pool of it. Rather, they have separate mental accounts. When they spend resources they keep track of that expenditure based on the mental account it came from.

- Gift from Income (Small Bucket Wallet): When a donor considers a $1,000 contribution against other expenses, the gift may seem too large a percentage of disposable income.

- Gift from Assets (Big Bucket Wallet): When this same $1,000 is considered as a percentage of total wealth (all cash savings and non-cash assets, shares, personal property, real estate, etc.), the gift may seem a relatively small percentage of investment income.

For more on the donor psychology at play see here.

Most donors would love to make an outsize impact if they could. And if they have appreciated assets, they can.

Appreciated Asset Gifts Cost Donors Less

A $10K gift from securities can be more valuable to the donor than the same gift from cash due to the tax benefits they’ll receive. Again, people spend what they perceive as unearned gains differently than hard-earned income. They can give more at the same net cost. This can drive long-term increases in giving.

- A cash gift brings an income tax deduction.

- An appreciated asset gift brings the sameincome tax deduction PLUS avoidance of capital gains taxes on the appreciation. And this benefit extends even to folks who don’t

In addition, with the new tax law which went into effect in 2018, donors who previously deducted capital gains taxes on their state income tax returns (80% of states) are no longer be able to do so. So savings from not having to pay these gains taxes have increased significantly.

It’s up to you to guide a donor in this direction.

And… there’s more!

Donors Who Love Their Stocks Need Not Change Their Portfolio

I love to share this strategy with donors who tell me they love all their stocks so much they can’t think of any they’re ready to give away.

Tell donors they can give stock to your charity and use the cash they would otherwise have donated to re-purchase the stock – thereby wiping out all their appreciation/capital gains liability and increasing their cost basis from this day moving forward.

So when they ultimately do sell the stock, they’ll pay less taxes.

This is a way to be super helpful to your donor, while at the same time generating a significant gift.

What Steps Should You Take to Secure Stock Gifts?

1. Set up a Brokerage Account

Often you can find a broker willing to offer discounted fees for nonprofits. When donors let you know they’re willing to make a stock gift, simply send instructions telling them precisely what to do:

Giving Appreciated Assets is as Easy as 1-2-3!

-

Decide which stock and the number of shares you wish to transfer to (provide your organization’s legal name).

-

Provide written instructions to your broker to deliver those shares to the following account that has been established for (provide your organization’s legal name). [Include account number; direct transfer number; broker name and company; phone, FAX and email].

-

Copy your letter of instruction to [Name and contact information for someone at your organization].

Also let donors know if they prefer to use their own broker you are willing to set up an account with their preferred brokerage. Be sure to let them know, however, you use the broker you do because they give you a preferred rate.

2. Actively Promote Stock Gifts on your Website and Online Communications

A lot of donors simply are not going to think of this on their own. Donors may never have considered giving from wealth rather than from spare income. Knowing this is not only possible, but easy, gives them freedom to be generous.

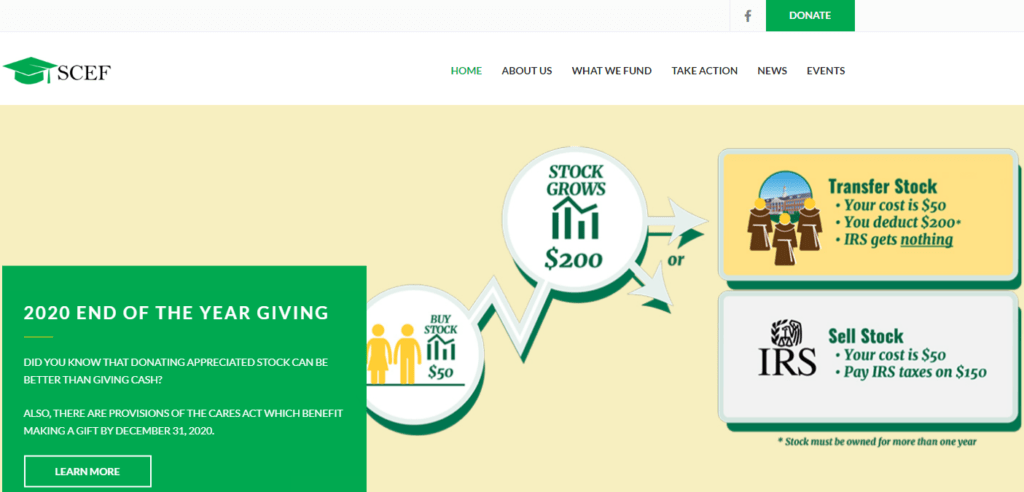

It’s your job to spell this out for them by keeping it simple. Since a picture can be worth 1,000 words this strategy, employed by the San Carlos Education Fund, is effective.

3. Include a Sub-Menu on Your Home Page (under Donate)

When website visitors click on or hover over your “donate” menu tab they should see “appreciated securities” as one of the “ways to give” options. Remember, you’re the one that needs to plant this idea. If donors see this on other charity websites, and not on yours, they’ll assume you don’t accept stock gifts.

Here are some charities who rock this online:

-

Save the Children. They include a chart summarizing the differences between simply selling $5,000 of stock in order to make a cash gift, making an outright $5,000 cash gift, or making a $5,000 appreciated stock gift. The after-tax benefits show the clear winner to be the direct stock gift.

-

Amnesty International. They make it an easy two-step process.

-

Boys and Girls Club of America. They spell out the different outcomes in narrative form.

-

American Red Cross. They use a simple three-step online form.

4. Give Fundraisers Extra Tools and Rewards to Generate Gifts from Assets

This makes good economic sense.

According to the landmark Russell James study, organizations that received non-cash gifts grew 50 – 66% in the last 5 years; nonprofits that accepted only cash grew only 11%. And this was true across the board, regardless of size.

Even small organizations experienced massive increases in contributions when they accepted non-cash gifts, especially securities. In fact, the smaller you are the more difference it makes!

So devoting some resources to promote bequests is likely to yield a high return on investment.

Conclusion

If you’ve been shying away from a ‘planned giving program’ because you don’t have expertise on your staff, all you need to learn is how to promote and accept gifts of stock. And this isn’t difficult at all.

Plus, if you don’t even want to accept stock gifts directly, there are Donor Advised Fund programs at community foundations and financial institutions where you can send your donors. Your supporters make a tax-deductible gift there, reap all the benefits of making a gift of appreciated assets, and then recommend a distribution to your charity.

No excuses; begin actively promoting acceptance of gifts of appreciated assets right now.

You need to.

If you’re set up to accept appreciated assets you’re making giving more beneficial. It’s a bit more hassle for your charity, but… if you want to walk the talk of donor centricity this is something you should seriously consider. If you don’t do it, another nonprofit will.

Appreciated assets are a blessing many donors are willing to share.

If one of your nonprofit’s wishes from the genie is to raise more money this year, you may just get this wish If you promote stock giving!

For Your Second Wish — and this is major…

“I want to tap into the 20% of donors who will account for 80% of my fundraising revenue! “WISH GRANTED!” All you have to do is enroll in this Certification Course for Major Gift Fundraisers. It helps to be taught by the very best in the business, and Richard Perry and Jeff Schreifels of the Veritus Group 100% share my approach to fundraising. Which is why this year I’m partnering up with them to offer you this amazing course. Register here through me and you’ll also receive a bunch of exclusive bonus worksheets and checklists from my own course (which I will not be offering this winter/spring).

“I want to tap into the 20% of donors who will account for 80% of my fundraising revenue! “WISH GRANTED!” All you have to do is enroll in this Certification Course for Major Gift Fundraisers. It helps to be taught by the very best in the business, and Richard Perry and Jeff Schreifels of the Veritus Group 100% share my approach to fundraising. Which is why this year I’m partnering up with them to offer you this amazing course. Register here through me and you’ll also receive a bunch of exclusive bonus worksheets and checklists from my own course (which I will not be offering this winter/spring).

Whether you already have a major gifts program, or could enhance your current program, this is something well worth your investment. Major gift fundraising by far the most cost-effective form of fundraising, costing on average 5 to 10 cents on the dollar (compared to 20 cents for renewal appeals, 50 cents for events and $1.00 – $1.25 for direct mail acquisition). Plus research shows you’ll likely get an ROI that’s 4 – 10 times what you invest to take this course.

Questions? Just hit ‘reply’ and email me. I’ll give you an honest answer as to whether this course will meet your needs. By the way, it’s a great career move as you’ll get a certification, 36 CFRE credits, and greatly-in-demand tools and skills.

Lamp image courtesy of Pexels. Thanks to Ken Levin for sharing the home page stock promotion example from the San Carlos Education Fund.