In Part 1 of this two-part series, I discussed cryptocurrency philanthropy basics.

Let’s say you’re intrigued, and want to dip your toes in the water?

How to Accept Crypto?

There is more than one way. These are listed in order of easiest to greatest need for tech and finance savvy.

- Donor advised funds and giving wallets. These are now being set up to accept cryptocurrency. If nothing else, you can alert supporters that if they have a DAF they can funnel crypto to you that way. Also, every.org and givewell are crypto wallets that act similarly to a DAF by accepting gifts from donors, then granting your nonprofit cash without you ever having to take custody of the asset. You never have to worry about accounting and legal concerns of accepting crypto.

- Software as a Service (SaaS solution) donor management platform. Organizations such as The Giving Block, engiven, Crypto for Charity by Freewill and Charitable Solutions, LLC are already set up to accept cryptocurrency on behalf of your organization (the list keeps growing). These dedicate crypto NGOs will sell the asset and transfer the proceeds to you. You can put a widget/button on your website to facilitate this. Crypto goes directly into exchange and is immediately traded for dollars (there is a small fee; around 1%). This is safe, secure and simple as generally the asset will be immediately liquidated (within milliseconds), which is super important with highly volatile assets like crypto. This protects you from a donor asking what you did with their $100,000, and you having to tell them you only realized $50,000 because you delayed a day to sell it.

- External custody. Behind the scenes, all platforms use a cryptocurrency brokerage or exchange. Three reputable ones are Coinbase Commerce, Kraken and Gemini. They typically charge 35 – 50 basis points per transaction. No donation processing or receipting is available. Nonprofits with expertise in asset management, trading and technology may consider building their own donation widget using these services. Be aware it can take many months to establish an account. Plus, you also need an “Alternative Asset Management Policy” [fold in crypto to your Gift Acceptance Policy; run this by your professional advisors and finance committee] to shield leadership.

- Self-custody. This is not for everyone and requires a hardware USB device that can be plugged into the computer when someone wants to make a transaction. They’re cold storage, kept off the internet, and highly secure. The downside is it requires a very savvy staff person and high security around custody. Plus it’s tricky to liquidate when you hold it in your hardware wallet. Some donors giving these digital assets like to see nonprofits holding those gifts as crypto, as part of an effort to see crypto go mainstream. If you have the ability to be strategic with investments, for example by building a reserve, you might consider holding onto crypto in its native form. UNICEF, for example, can receive, hold, and disburse cryptocurrency with its UNICEF CryptoFund. Again, you’ll want an “Alternative Asset Management Policy” to guide when you’ll sell.

How to Promote?

It’s probably not suitable for a dedicated mailing or email blast to everyone, because it’s relevant to too few people.

But you DO want to let your supporter base know you’re now ready to safely, simply and securely accept crypto. For folks who own it:

- your being able to accept it facilitates their giving to you, and

- often facilitates their giving you more than would otherwise have been the case.

Experience shows there’s high correlation in amount of giving and amount of publicity.

The money won’t suddenly begin raining down. But letting the world know you accept this form of currency will give you a leg up. Make it clear you accept these types of gifts, and build trust by becoming confident in your ability to talk to donors (and their professional advisors) about different ways they can give. Both the advisor and the donor have to trust you. The folks who own crypto have been looking for this. Help them find it!

- Put the “how to give simply, safely and securely” on your website. Many SaaS providers are now adding this to the website landing pages they’ll create for you; talk to your provider. But don’t just put it on your website and hope people will find it by browsing.

- Write about your ability to accept it in your newsletter.

- Write about your ability to accept it in your blog.

- Write about it in social media.

- Make one-page handouts you can send to interested supporters.

- Put a widget on your website so the transaction is simple.

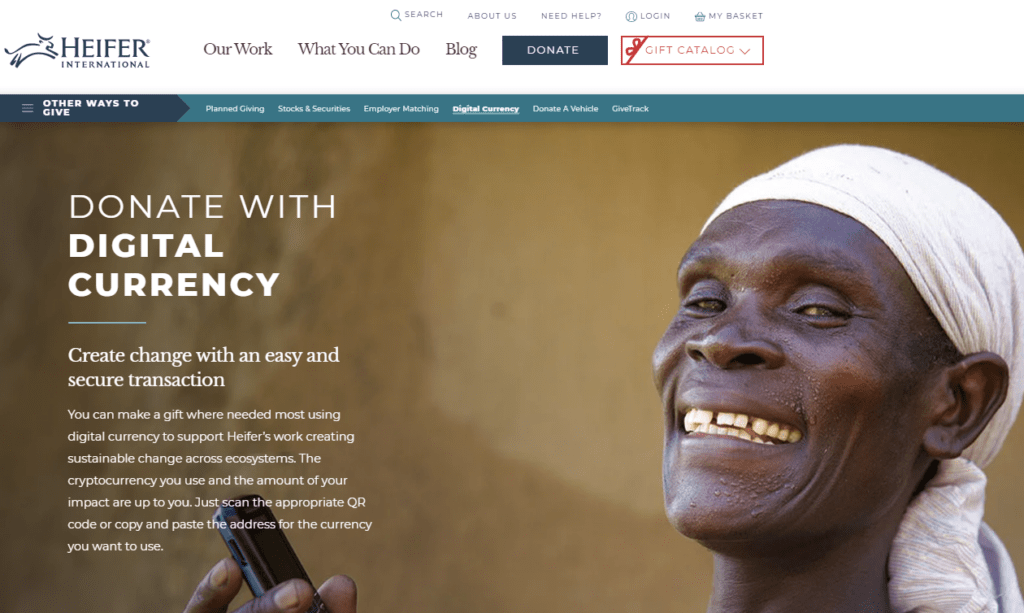

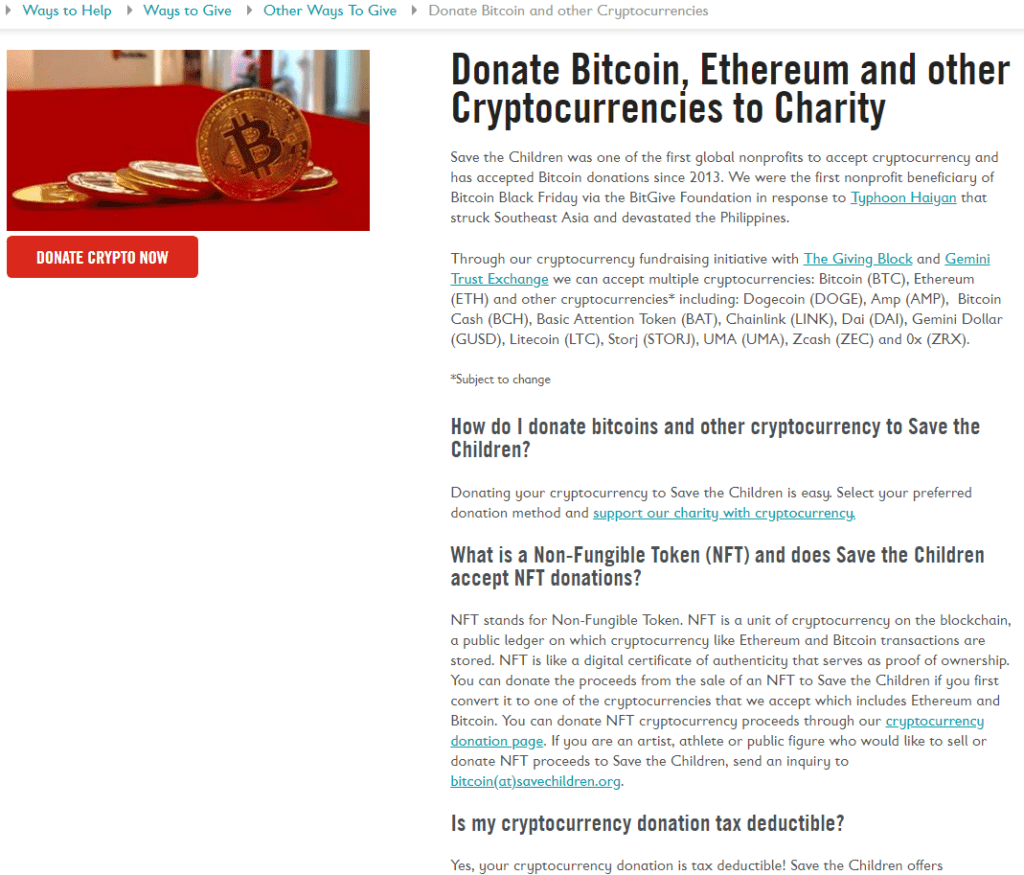

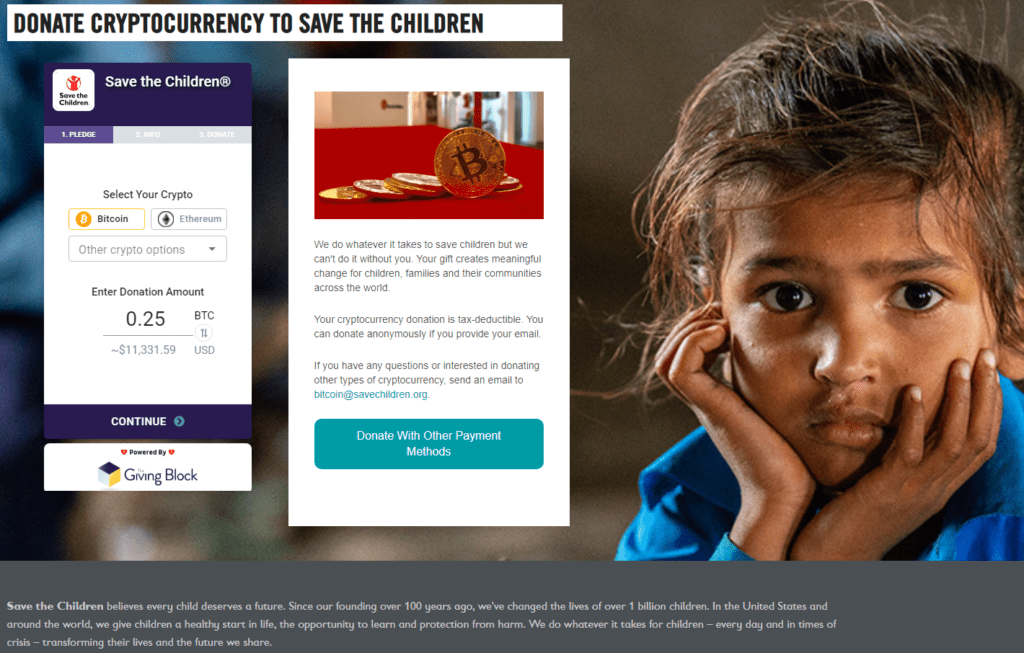

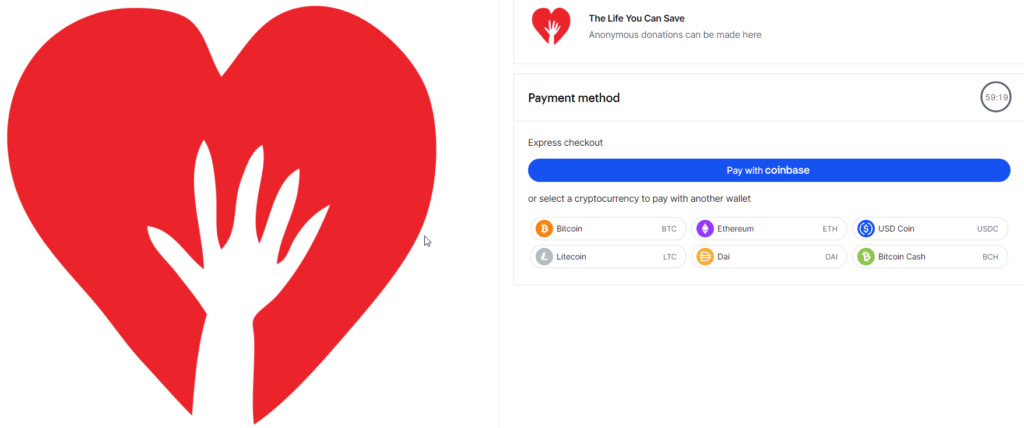

See some promo examples below:

Heifer International (above) promotes gifts of digital currency on their “other ways to give” landing page, including easy-to-use QR codes

2. Save the Children (above) promotes gifts of digital currency on their “other ways to give” landing page, including a Giving Block widget.

3. The Life You Can Save (above) uses this widget from the Coinbase Exchange platform

4. UNICEF (above) promotes their own cryptocurrency fund

How to Get Leadership Buy-In?

Identify the people in your organization who could say “no,” and talk to them. Involve your board, legal and finance teams. What would it take to get them to a “yes” or “maybe?”

This is the big hurdle, but it’s becoming easier to jump over as more and more nonprofits jump on board the cryptocurrency bandwagon.

Let Someone Else Do the Talking

- One way is to partner with a donor management platform to have them do the education piece for executive directors and chief financial officers. Again, check out engiven, Every.org and The Giving Block.

- You might also begin by talking with another respected organization that’s jumped on the “we accept crypto” bandwagon. [Search the internet for “Nonprofits accept cryptocurrency” to find one you think would impress your “powers that be.”]

Prepare to Play Devil’s Advocate

- Does crypto have a dark history and/or negative reputation? Yes. The earliest adopters came in when this was an unregulated frontier. The early internet was used for a lot of illicit activities as well. However, once legitimate enterprises entered the landscape, the regulators caught up. It’s not perfect, but the preponderance of internet transactions are legal. Today 99% of crypto use is also legal.

- Are there environmental concerns? Yes. And I don’t want to make light of these. But the fact as of this writing hundreds of millions have been donated to Ukraine in crypto philanthropy does give one pause. And crypto is expected to become more energy efficient over time. And Pat Duffy at the Giving Block notes emails used to use more energy than mailing a letter. That didn’t stop nonprofits from using email and other online methods of fundraising to reach more supporters and raise more money to solve the world’s most pressing problems.

Remind Me Why We Should Consider Doing This?

Your job is to be a philanthropy facilitator, making it easy for people to give to you.

It’s not your job to try to educate people about crypto or persuade them to run out and buy some. People who don’t own it won’t notice it. People who do, particularly if they’re already your donors, will. As a result, you may receive a larger gift than you’d otherwise have received.

EXAMPLE: GenXer Marshall bought Bitcoin for $200 eight years ago. Today it’s worth $20,000. If he exchanges it for something he wants, he’ll owe the IRS capital gains tax on the $19,800 worth of appreciation. That’s not worth it to him, so the money is just sitting in his Bitcoin account. When he learns he can give it to you, make the full $20,000 available for social benefit purposes, and also avoid paying income and capital gains taxes, he’ll likely be overjoyed at this opportunity. Especially if he needs a deduction to offset other gains.

Cryptocurrency doesn’t seem to be going away.

In fact, did you know El Salvador adopted bitcoin as an official currency due to a community-based movement to help those in the unbanked world have a place to save/invest and make electronic transactions? All the small shops, electric and water companies, etc. now accept it. Also, there’s growing interest in channeling some of the wealth created by crypto to social benefit. The Giving Block has launched the Crypto Giving Pledge, which asks individuals to donate 1% of their crypto to nonprofits.

The time to think about this seriously has come.

It’s an opportunity to meet some of your donors where they are, and others where they may be soon.

Is pioneering part of your culture?

Are you willing to take calculated risks?

Do you have an innovation mindset?

Do you exercise your innovation muscle? Use it or lose it.

How to Engage and Retain Crypto Donors

They merit their own strategy.

“You shouldn’t put new wine in old bottles. If you do, the bottles will break.”

–Ettore Rossetti, Save the Children.

As with all other donor cohorts, it’s imperative to meet them where they are. To the extent possible, show them you know them. Once someone gives crypto, for example, you don’t want them to end up on a list asking them to give $20. Nor do you want to send them to a landing page where giving crypto isn’t even an option.

As a general rule, crypto philanthropists don’t respond to traditional channels like direct mail, email and even all general social media. There’s crypto Twitter, which is a primary channel. They also use more cutting-edge channels like What’s App, Telegram, Clubhouse, Reddit, text, and gaming integrations.

They often go by pseudonyms. And they may use a different vocabulary than other donors.

So, if you haven’t read Part 1, “Deep Dive into Cryptocurrency for Nonprofits,” go back and take a look. And keep your eyes peeled for news about crypto philanthropy so you’re able to seize opportunities as they present themselves.

NOTE: This article is for informational purposes only and not intended as legal or financial advice. Please consult your own professional advisors for the latest and most accurate information. This article makes no representations or warranties as to the accuracy or timeliness of the information contained herein. I learned a lot from Matt Hayes, engiven co-founder, and you should certainly feel free to contact him directly with any questions.

Want to Integrate all Your Major gift Fundraising and Marketing Initiatives?

Accepting crypto is but one piece of the puzzle. To put your best foot forward, assure you’re not leaving any money on the table, and maximize your ability to build the lasting and growing donor relationships that will sustain you over time, I recommend my Major Gifts Playbook. It’s four-volumes, bundled together at a steep discount. You’ll find everything you need to know about building, growing and sustaining a major gifts program that will stand the test of time. Folks have told me they keep this in a binder on the shelf over their desk, and refer to it time and again. More than one has called it “my major gift bible.” I hope you’ll find it a similarly useful resources.

Accepting crypto is but one piece of the puzzle. To put your best foot forward, assure you’re not leaving any money on the table, and maximize your ability to build the lasting and growing donor relationships that will sustain you over time, I recommend my Major Gifts Playbook. It’s four-volumes, bundled together at a steep discount. You’ll find everything you need to know about building, growing and sustaining a major gifts program that will stand the test of time. Folks have told me they keep this in a binder on the shelf over their desk, and refer to it time and again. More than one has called it “my major gift bible.” I hope you’ll find it a similarly useful resources.

But if you’re not satisfied, I offer a no-questions-asked, 30-day, 100% refund. So you can’t go wrong.

I hope you’ll join me in raising the most money you possibly can for your important mission. And, while you’re at it, helping donors find the meaning and purpose they seek. We’re all part of the same village, just trying to make our world a better place.

Photo by Wance Paleri on Unsplash