Philanthropic giving has been on a downswing for a while, but this past year’s data is notable due to distinct changes in donor behavior.

Philanthropic giving has been on a downswing for a while, but this past year’s data is notable due to distinct changes in donor behavior.

I don’t want you throwing your hands up in despair. Rather, I want you to take a good hard look at the data so you can develop a plan with strategies that will give you the best chances for success in the current era.

Rather than taking a reactive stance (“Oh no! Less donors means we need to decrease our fundraising goal.”), I encourage you to take a proactive stance (“Hmmn… Less donors overall means we have to really pay targeted attention to keep the ones we have.”)

“Donors continue to give, bequests continue to come in, corporations and foundations have reworked the way they give, and nonprofits continue to thrive, accomplish and make a positive impact on our world.

Nonprofits are more important than ever, for many reasons. Now is not the time to jump ship or give up, rather, it’s time to look at the trends as a wake-up call. The time to substantively change how fundraising is done is now.”

— Lisa Z. Greer, Philanthropy 451

To prepare yourself to get proactive and become contemporary in your campaign design, planning and implementation, let’s review the facts.

Wake Up To the Data

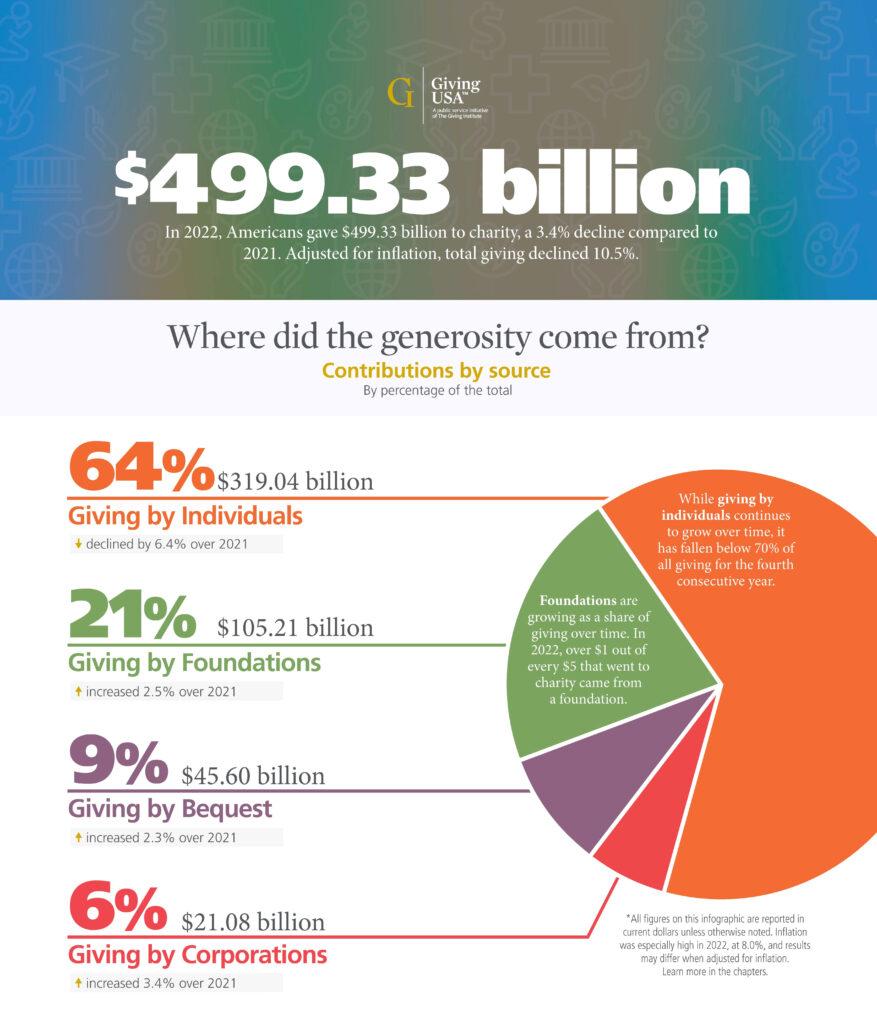

Let’s begin with the 2023 Giving USA report, revealing giving in 2022 to be $499.33 billion, down from $516.65 billion in 2021. That’s a whopping 13.4% drop, adjusted for inflation. It’s only the fourth time in history giving, year-over-year, has been down. Even during the years of the pandemic and social unrest in 2020 and 2021 giving stayed resilient.

But is it really such a huge surprise, worthy of a “sky is falling” prognosis? Let’s take a closer look at what really happened last year, and in how that compares with past trends.

I. Less Donors and Dollars Overall

Total giving declined 3.4% in current dollars – 10.5% after adjusting for inflation. That sounds really bad, but it’s understandable when one takes into account the fact 2020 and 2021 saw exceptional increases in philanthropy as a response to historic events — a global pandemic, economic crisis and recovery, and efforts to advance racial justice. Even in ordinary times such gains might be unsustainable. But in 2022 another shoe dropped, bringing about a 40-year high inflation rate, high interest rates, steep declines in the stock market and overall economic uncertainty. Giving is not done in a vacuum. And when donors feel economically insecure, they give less.

CLOUD-CLEARING HINT: Less donors has been a trend for over a decade. A study by the Lilly Family School of Philanthropy found the percentage of U.S. households donating to charity fell from two-thirds in 2000 to half in 2018. Yet this doesn’t necessarily mean Americans have become less generous. People are participating in philanthropy in other ways, including crowdfunding campaigns, impact investing and in-kind giving.

What creative fundraising campaigns have you launched recently, including peer-to-peer, in-kind and monthly impact?

II. Less Individual Donors — Shrinking Slice of Fundraising Pie

For all the years I can remember sharing the Giving USA report results, individual giving plus bequests accounted for approximately 80% of all giving. Last year, while individual gifts remained the largest slice of the fundraising pie (64%), and bequests (9%) remained strong, the total from individual donors declined significantly to just 73%. But this is not as much of a sudden anomaly as it may appear (at least to my stuck-in-the-past memory). Per the Fundraising Effectiveness Project data, numbers of individual donors and dollars have been on the decline for at least the past decade.

CLOUD-CLEARING HINT: Especially problematic has been donor retention, particularly the less than 20% rate for first-time donors. The most recent report from M+R concurs this is cause for concern, finding only 16% of online donors who made their first gift in 2021 gave again last year. It’s not just first-time donors who are the problem either. For the first quarter of 2023, retention was down in all categories.

What have you been doing specifically to increase donor retention?

III. More Foundation and Corporate Giving

While the GivingUSA report shows growth in current foundation and corporate dollars from 2021 to 2022, these slices of the fundraising pie (21% and 6% respectively) remain small compared to outright individual giving and bequests.

CLOUD-CLEARING HINT: You probably should not take this as a sign to double down on raising money from these relatively, and consistently, small sources at the expense of ramping up individual and legacy giving strategies.

Are you matching your resource outlay to the amount of funding different sources yield or are you “all in” on a strategy that may not offer your best return on investment?

IV. Focus of Giving Changed – or Did It?

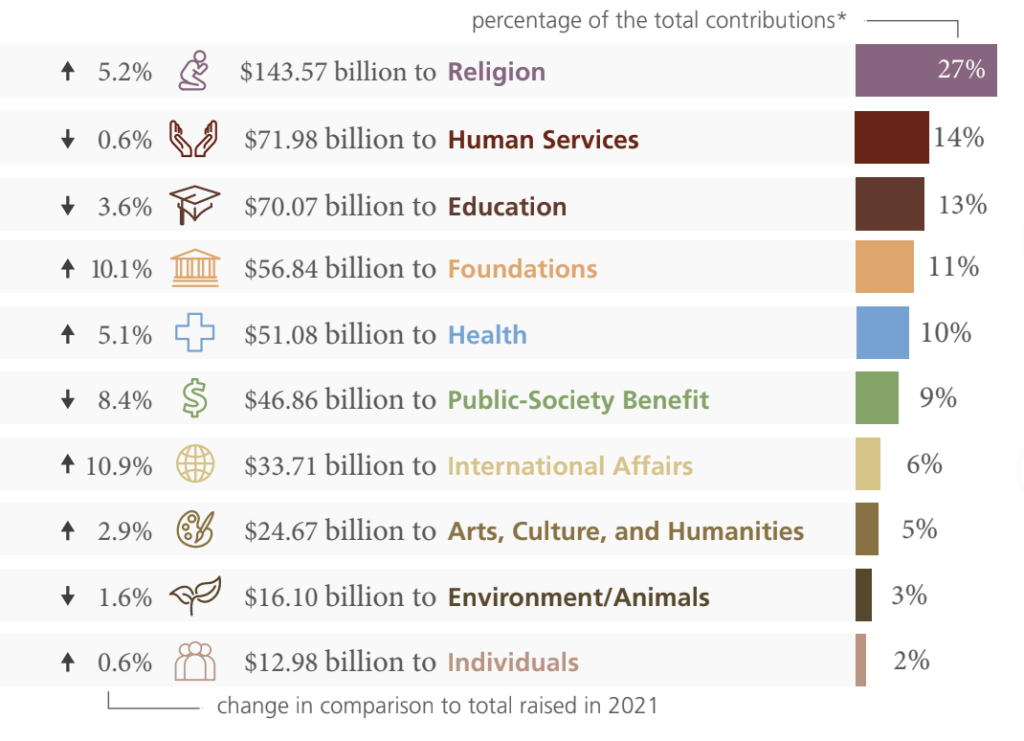

Giving USA reported giving to religion continued its significant multi-year drop – from 58% in 1983 to 27% in 2022 — but, it’s still the biggest slice of the pie (+5.2%). Human services (-0.6%) and education (-4%) followed, declining just a bit. International giving grew the most, almost 11%, likely due to current events like Russia’s invasion of Ukraine and other humanitarian causes. Giving to arts, culture and humanities continued its pandemic growth trajectory, albeit on a much smaller scale than in 2020 and 2021 (+2.9%).

One notable trend is the increase in giving to foundations. This is likely due to two developments: (1) changes in tax laws that caused more people to “bunch” giving by setting up donor advised funds(DAFs) or private foundations, and (2) a generational wealth transfer generating significant wealth events for families who had to decide where to park that wealth. If donors didn’t have a specific charity in mind to be the beneficiary of their philanthropy after selling a company or receiving an inheritance, it made sense to set up a vehicle (foundation, DAF or charitable trust) from which they could make grants over time and also receive tax benefits.

CLOUD-CLEARING HINT: Where people give, and from which wallet, are personal decisions influenced by their own current interests, motivations and finances. Rather than saying something nutty like “no one will give to the arts during a period of social unrest and climate emergency,” think about what your arts nonprofit can contribute to the present conversation. For example, over the past few years many arts and humanities organizations talked about the intersection of social justice, diversity, equity, and inclusion with the arts, sharing stories focused on building empathy and collective power. They got up close and personal with their supporters, sharing more transparent, direct and impassioned messaging than ever before.

What are you planning to do to learn more about your donors’ dreams so you can help them achieve them, and do you know whether they participate as a family in making philanthropic decisions (perhaps through a DAF or private foundation)?

V. Overall Giving Pie Shifting to Ultra-Wealthy

Until this year, when one looked at total overall giving, the decline in numbers of donors was masked by the increase in average gift sizes from the ultra-wealthy. These folks made up for money lost from smaller donors, prompting savvy nonprofits to ramp up their major giving programs. As a smart fundraising strategy, almost without exception, this worked well (see here, here and here). So well, in fact, one might reasonably conclude doubling down on this strategy would reinvigorate giving to the point where major gifts once again rebounds to make up for those no longer giving to traditional or more grass-roots philanthropies.

However, simply looking at raw donation totals obscures the fact wealthy donors choose different beneficiaries than less-wealthy ones. In early 2022, the Chronicle of Philanthropy published its annual list of the 50 top U.S. philanthropists. Of $25 billion the group donated to charity in 2021, 69% — more than $17 billion — went to private foundations. The second-largest chunk, worth more than $2.6 billion, went to donor-advised funds. Colleges and universities, the top category of working-charity recipients, received nearly the same amount as donor-advised funds, leaving the remaining 11% of gifts to be distributed across all other nonprofits.

CLOUD-CLEARING HINT: Some are concerned the shift to major donor philanthropy may reflect priorities of a too-small slice of the population, leading to an inequitable distribution of philanthropic largesse. Maybe. But I encourage you to think from the perspective of your nonprofit, and what you can do to attract philanthropy from wealthy donors. Because it is not at all true these folks give only to higher education and hospitals. And when they give to a DAF or foundation, they still have agency to recommend grants to you – provided you do your due diligence, make a strong, resonant case for support and work to find any possible linkages that will enable you to get your foot in the door and make a connection with these prospects.

What are you doing to share the merits of your mission and attract gifts from affluent households, 90% of which made philanthropic gifts in 2020?

Check out Top 10 Strategies to Navigate the Current Cloudy Nonprofit Landscape, where I suggest specific steps to maximize your investment of limited development resources.

Welcome to the Certification Course for Major Gift Fundraisers

This is the best way to avoid all the frustrating trial and error that comes from not having the best teachers in the business from the ‘get go.’ I’m partnering up with The Veritus Group to offer you this amazing online course. You’ll get more than you can imagine, in a combination of readings, podcasts, webinars, live phone-in calls, peer group conversations, individual check-ins and even a free data assessment if you wish. Plus,at completion, you’ll receive a major gifts certification as a “Veritus Scholar” + 36 CFRE credits. If you want your E.D., Finance Officer or other program director to take this with you, there’s a companion Certification Course for Managers and Executives that will be running simultaneously. You can mix/match and register for one or both simultaneously to qualify for a group discount. Sign up with a group of 3 or more from your organization and each added person saves 20%!

This is the best way to avoid all the frustrating trial and error that comes from not having the best teachers in the business from the ‘get go.’ I’m partnering up with The Veritus Group to offer you this amazing online course. You’ll get more than you can imagine, in a combination of readings, podcasts, webinars, live phone-in calls, peer group conversations, individual check-ins and even a free data assessment if you wish. Plus,at completion, you’ll receive a major gifts certification as a “Veritus Scholar” + 36 CFRE credits. If you want your E.D., Finance Officer or other program director to take this with you, there’s a companion Certification Course for Managers and Executives that will be running simultaneously. You can mix/match and register for one or both simultaneously to qualify for a group discount. Sign up with a group of 3 or more from your organization and each added person saves 20%!

Use my exclusive Clairification discount Code (CA5) to save $100.

I hope you’ll join us! This course is worth it, and you’re worth it! Email me right away at claire@clairification.com for the group savings, or with any questions. I’ll respond personally with honest answers.

Thanks for all you do to create a better and more caring world,

Claire