Only about 10% of Americans itemize tax deductions today. Prior to 2017 it was 31%; that was more, but still a minority.

Only about 10% of Americans itemize tax deductions today. Prior to 2017 it was 31%; that was more, but still a minority.

Yet you’re likely blithely sending out year-end messaging replete with “Only 1 week left to grab your tax deduction!”

Who cares?

At best, it’s just ten percent of your donors.

And since the standard deduction more than doubled with the enactment of the Tax Cuts and Jobs Act in 2017, with a major increase between 2022 and 2023, even fewer folks will be itemizing this year and in coming years.

The time for blanket tax savings messaging is sunsetting.

Yet the sun is rising on informing your most generous supporters of a variety of tax beneficial giving strategies of which they may be less aware.

Top Tax-Beneficial Ways to Give in 2023

1. Gifts of Appreciated Assets

I’ve written before of the groundbreaking study by Dr. Russell James J.D., Ph.D., CFP®, professor in the Department of Personal Financial Planning at Texas Tech University, finding nonprofits that consistently received gifts of appreciated stocks grew their contributions six times faster than those receiving only cash.

- Received only cash gifts = 11% growth.

- Received any kind of non-cash gift = 50% growth. Included gifts of personal and real property and deferred gifts.

- Received securities non-cash gifts = 66% growth. Massive difference from just this one strategy!

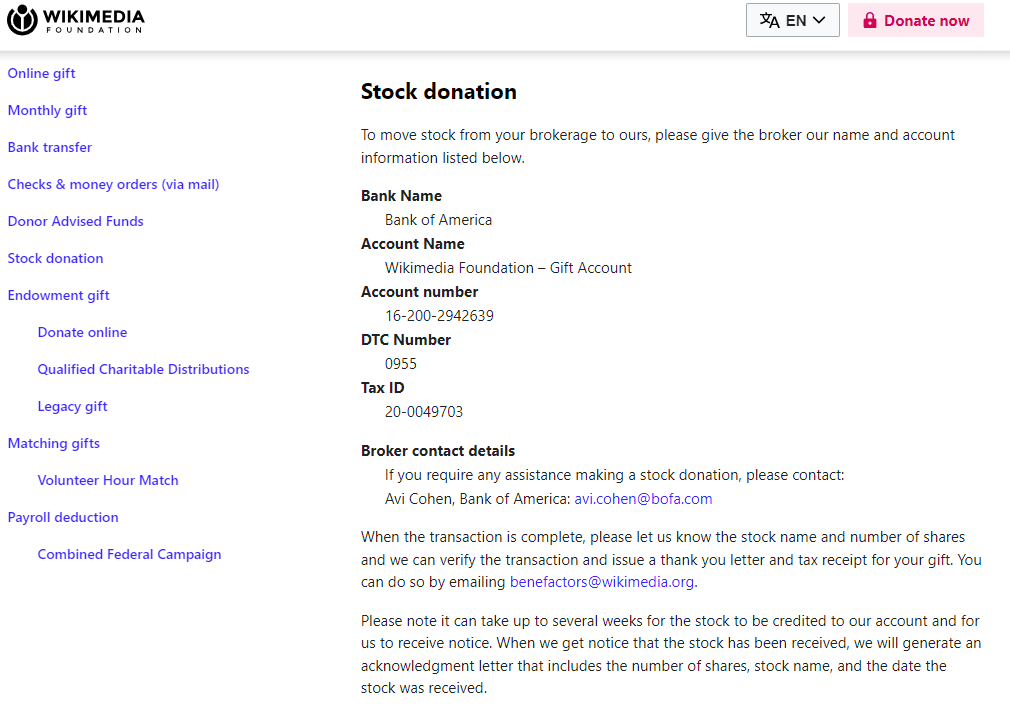

At year’s end it just makes sense, for you and for donors, to explicitly promote gifts of appreciated assets. Here is a great example of how to make this easy for donors, from the Wikimedia “Ways to Give” donation landing page .

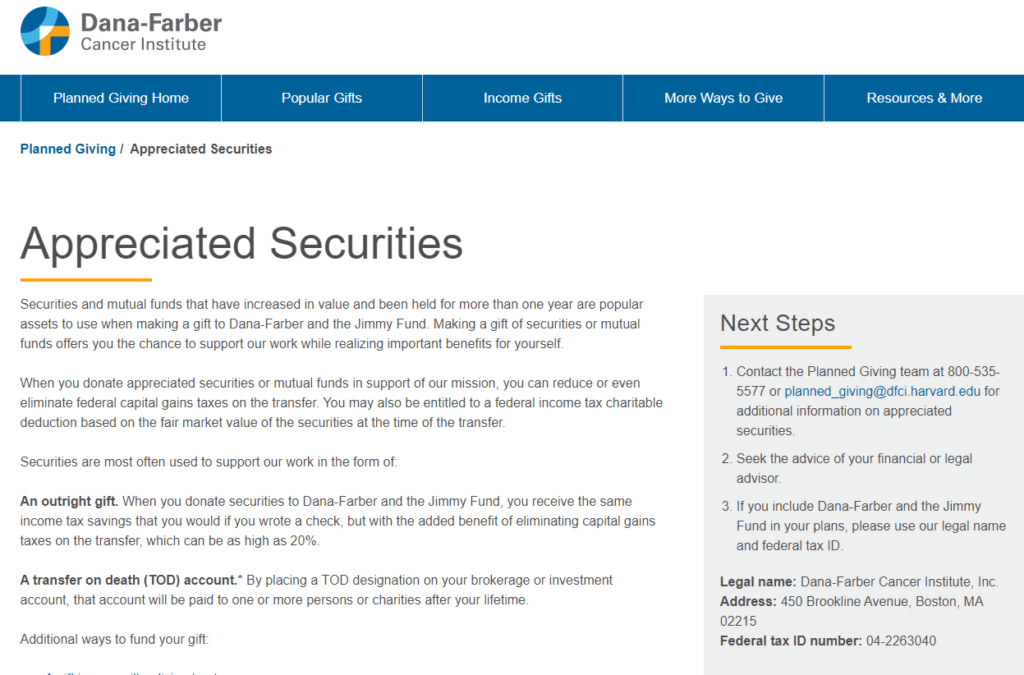

Here’s another example from Dana Farber Institute

Note that appreciated assets gifts cost donors less because in addition to income tax savings they bypass capital gains on the appreciation, meaning they conceivably can make you a larger gift!

Win/win.

It’s important to note researchers have found people don’t treat all their money as if they have one big pool of it. Rather, they have separate mental accounts. When they spend resources, they keep track of their expenditure based on the mental account it came from.

-

Gift from Income (Small Bucket Wallet): When a donor considers a $1,000 contribution against other expenses, the gift may seem too large a percentage of disposable income.

-

Gift from Assets (Big Bucket Wallet): When this same $1,000 is considered as a percentage of total wealth (all cash savings and non-cash assets, shares, personal property, real estate, etc.), the gift may seem a relatively small percentage of investment income.

Most donors would love to make an outsize impact if they could. And if they have appreciated assets, they can.

2. Bunching Gifts to a Donor Advised Fund (DAF)

The standard deduction for married couples filing jointly was $12,700 in 2017. For 2023 it rose to $27,700. For those age 65+r or blind, an additional standard deduction of $3,000/person if married or $3,700 if single can be added to the regular standard deduction. As a result, donors who previously itemized deductions may find it advantageous to simply take the standard deduction. This being the case, their charitable giving won’t be influenced by the possibility of tax savings.

However, there’s a way for generous donors to have their cake and eat it too. Known as “bunching,” it’s a combination of itemizing and taking the standard deduction in alternating years. In year one, the donor makes a large gift to a DAF. They itemize deductions. The next year they continue to give from the residual in their DAF, taking the standard deduction. Here’s a chart from Schwab Charitable showing how this can result in greater tax savings than two years of standard deductions.

Schwab Charitable even has a handy Bunching and Tax Savings Calculator on their website donors can use to see if the math adds up for them. Why not let your donors know about this?

3. Direct Gifts from an IRA

This year donors age 73+ are required to take a minimum distribution from their IRA. Some donors don’t need this income, and it can flip them into a higher tax bracket. This not only causes them to pay more in taxes, but can also influence their costs for Medicare and the taxability of Social Security benefits.

However, there’s a charitable “fix.” Known as the “Charitable IRA Rollover” or “Qualified Charitable Distribution (QCD),” anyone age 70.5+ may donate up to $100,000 ($200,000 for couples) directly from their IRA to a qualified charity. While not technically deductible by them, the transfer bypasses their income wallet, going directly from their asset wallet to charity. The overall savings to them can be even better than getting a straight tax deduction. This is due to the:

- Income tax bracket factor, as described above.

- Standard deduction being used more frequently, helping donors who don’t itemize be able to enjoy both the standard deduction and added tax advantages.

Note: Donors can only make QCDs from IRAs and not from 401(k)s or 403 (b)s.

Also, starting in 2023, donors can make a one-time IRA rollover gift up to $50,000 to a charitable remainder trust or charitable gift annuity. If your organization promotes these types of deferred gifts, this is something of which you should be aware.

What Donors Don’t Know, They Won’t Do

It’s your job to let donors know what benefits they may take advantage of. While I always recommend you let donors know you are not in the business of offering professional legal or financial advice, and they should consult with their own advisors, this doesn’t mean you can’t inform people of ways to give that may be beneficial. Otherwise, they simply won’t give as much as they could, and that will be to everyone’s detriment.

It’s the bare minimum to tack “this gift is tax deductible to the extent provided by law” onto the end of your appeal or bottom of your donation landing page. Donors perceive this as relatively meaningless ‘fine print.’ Mildly reassuring, but certainly not persuasive. Most readers won’t really understand what it means. You can do better.

Rather than leading from the “end of” perspective, lead from the “new beginning” perspective.

Make this a year where you focus on ALL the benefits donors derive from giving.

Remember this: Fundraising is a value-for-value exchange. The donor gives you something of value, usually money and/or time. You return something of value, usually an intangible “feel good.” While it’s true the main motivations for giving have to do with meeting a donor’s needs for connection, community, self-esteem, fulfillment of a moral or religious obligation, or just feeling pure joy, sometimes the donor will be further incentivized by gaining a tax savings.

Want More Year-End Strategy Tips?

Your all-in-one guide for ticking off things you may be missing or not quite have finished

If you’ve got your year-end fundraising plan completely under control, yay you! If you need to spend a bit of time making a list of ‘to-do’s, now’s a good time. Grab my Year-End Fundraising Solution Kit – To-Do’s and Checklists. It’s a 63-page-long, step-by-step comprehensive road map to effective year-end fundraising. After working 30+ years in the trenches, I can vouch for this stuff. It’s tried and true! Not satisfied? All Clairification products come with a 30-day, no-questions-asked, 100% money-back guarantee. You truly can’t lose!

And if you can’t do everything you wish you could this year, get ahead of the game and put it on your list for next year.